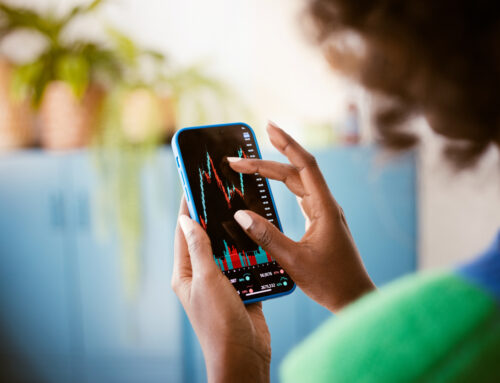

It’s no secret that there’s been a lot happening in our economy lately. You may have seen headlines about interest rate hikes or the debt ceiling. We’re still feeling the aftereffects of economic decisions made during the pandemic and trying to figure out how that unprecedented event is going to affect our economy in the long term. It can be important to keep up to date on the larger economic happenings, especially if you are a person who is headed into retirement. Markets, prices, and economic events play a key role in what decisions you make with your retirement funds, timelines, and budgets.

Inflation and Interest Rates

Probably the biggest headline for the last year or so has been interest rates. The Federal Reserve reduced interest rates during the pandemic to encourage spending and buoy the economy during a period of massive economic difficulty.[1] A side effect of this increased spending is that inflation crept up very quickly.[1] You may have noticed the costs of your expenditures over the last few years have gone up.

The Federal Reserve is working to reverse that sudden rise in inflation by increasing interest rates.[1] If you know anyone who has taken out a loan recently, or if you are looking at loan prices yourself, you have probably seen that the interest rates are much higher than they used to be. In this aim, the goal of the Federal Reserve is to make the costs of borrowing money less appealing to reduce overall spending, put pressure on businesses and how they price products in doing so, and thereby reduce the rate of inflation.[1] So far, some believe they have gone too far in pressuring businesses and economic activity in their efforts. But others believe they have at least done a good job of curbing inflation.[1] However, recent inflation data has decreased at a lesser rate than predicted, meaning inflation may not be as under control as many had thought.[3]

Government Debt

The other big piece of news this year was the government debt ceiling. Congress voted to raise our debt ceiling and stop the United States from defaulting on its loans.[2] The effects of a governmental default would have been very serious and likely would have been very bad for even everyday Americans, but the crisis was thankfully avoided.[2] However, because of the ballooning, there may be some fallouts to come.[2]

It has been a rocky time in the financial world as we have seen many changes in the last few years. If you are looking for someone to help you through your financial journey, consider reaching out to one of our professionals today for a complimentary review of your finances.

[1] https://www.forbes.com/advisor/investing/current-inflation-rate/

[2] https://www.washingtonpost.com/business/2023/08/01/downgrade-federal-government-fitch-debt-ceiling/

[3] https://finance.yahoo.com/news/nasdaq-slips-dow-rises-as-wall-street-weighs-inflation-data-stock-market-news-today-200035666.html