Learn More About Your Financial Journey

Browse Our Guides & Download Instantly

At Structured Wealth Management, we create a customized plan based on your values and beliefs about money that reflect your unique goals and priorities.

Below, we are offering complimentary downloads of some of our top financial insights to help you assess your current investment and retirement strategies. We hope you find these retirement and financial white papers helpful!

Social Security Guide

Optimizing Your Social Security In Today’s World

Social Security planning is one of the most important elements in any retirement plan, but getting the most from your Social Security benefit can also feel complex and frustrating. In our guide, “Optimizing Your Social Security in Today’s World,” you’ll uncover practical tips and easy-to-understand steps to get the most out of your Social Security benefits.

Tax Planning Guide

Work To Reduce Your Taxes This Year And In The Future

After the many changes to the financial landscape that came over the last few years, filing your taxes this year could be complicated. Maybe you stopped working, realized investment losses, created an estate plan, or went from itemizing to claiming the standard deduction or vice versa. There are many factors that can impact how your tax level may change and if you need to rethink your tax strategy.

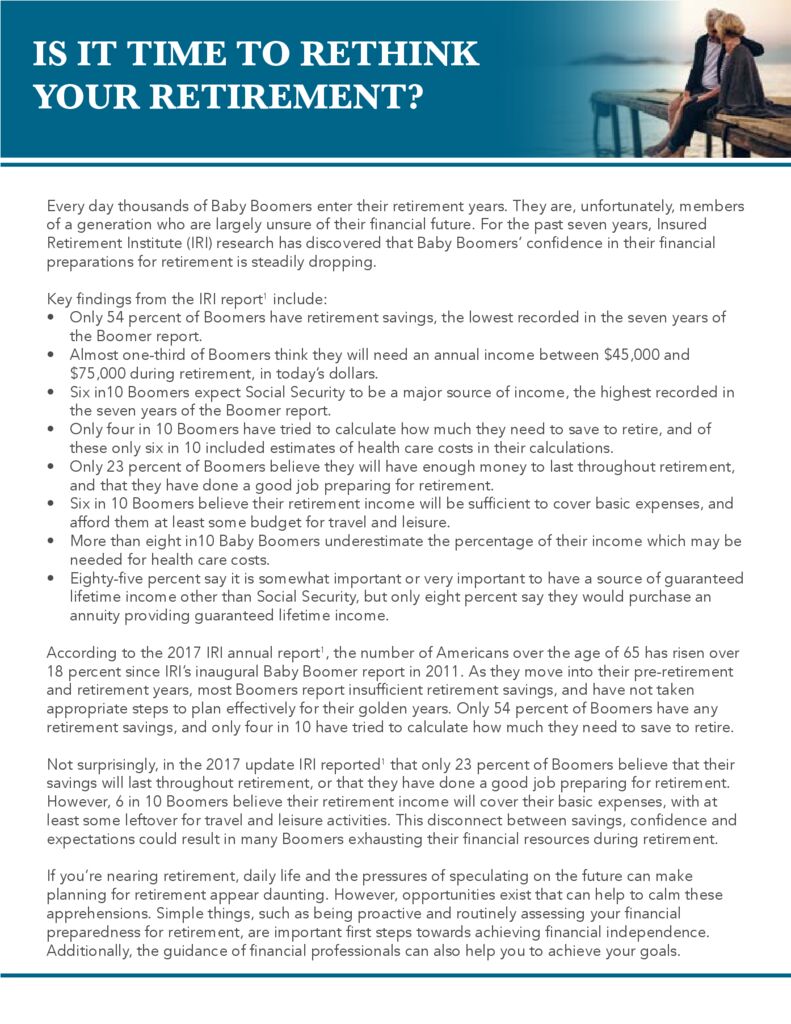

Tips to Help Avoid “Market Panic” Reaction

Have a Plan to Help Protect Your Savings from Major Market Corrections

Planning for retirement is never a “set it and forget it” activity: There are unexpected disasters, market drops, and changing laws that invariably cause retirees to reevaluate their plans. Diseases, natural disasters, or political instability are examples of things that can cause market downturns or drops. Such occurrences are difficult to predict, and their consequences can cause people to make hasty decisions with their finances. However, you can prepare yourself for a downturn by having a solid financial strategy in place. The most recent bout of “market panic” likely won’t be the last one you’ll see in your lifetime, so why not have a plan to address future market drops? If you’re concerned about your financial security as you near and enter retirement, assessing your risk tolerance, reevaluating your portfolio, and seeking professional advice could be a good idea.

Retirement and Inflation

What To Know And How To Prepare

In 2024, we saw a continuation of market turbulence, loosening of labor markets, and lighter inflation due to economic tightening from the Federal Reserve, yet a signal that they’ll start decreasing interest rates. Compared to a couple of years ago, you may have noticed higher prices on the items you buy every week and may be wondering if we’ll continue to see high inflation. While inflation may be coming down, as long as it is positive, prices are rising.

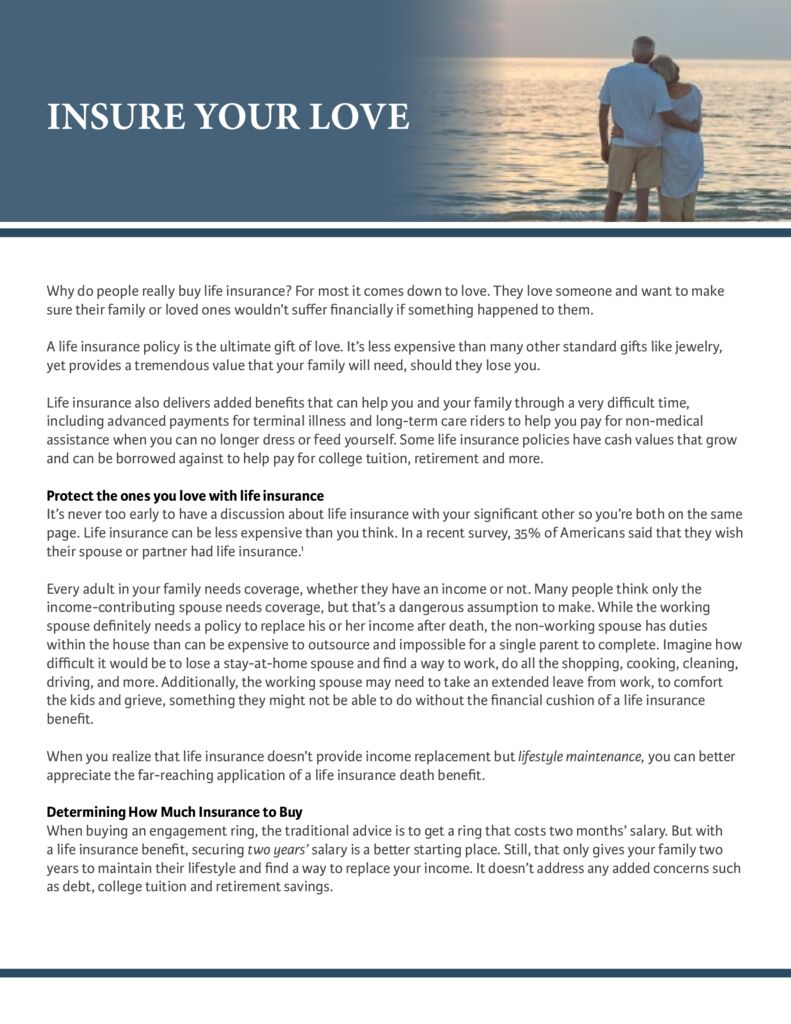

Your Guide To ROTH IRA’s

Conversion and Advanced Tax Planning

An IRA is an investment account that you own that typically holds stocks, bonds, mutual funds, ETFs, and more. It is structured and regulated with limitations and tax advantages for using the account to grow a fund that is then used to provide you income in retirement. The Roth IRA is a tax-advantaged retirement account, but some of its tax advantages are structured differently than the Traditional IRA.